From Vision

to Value

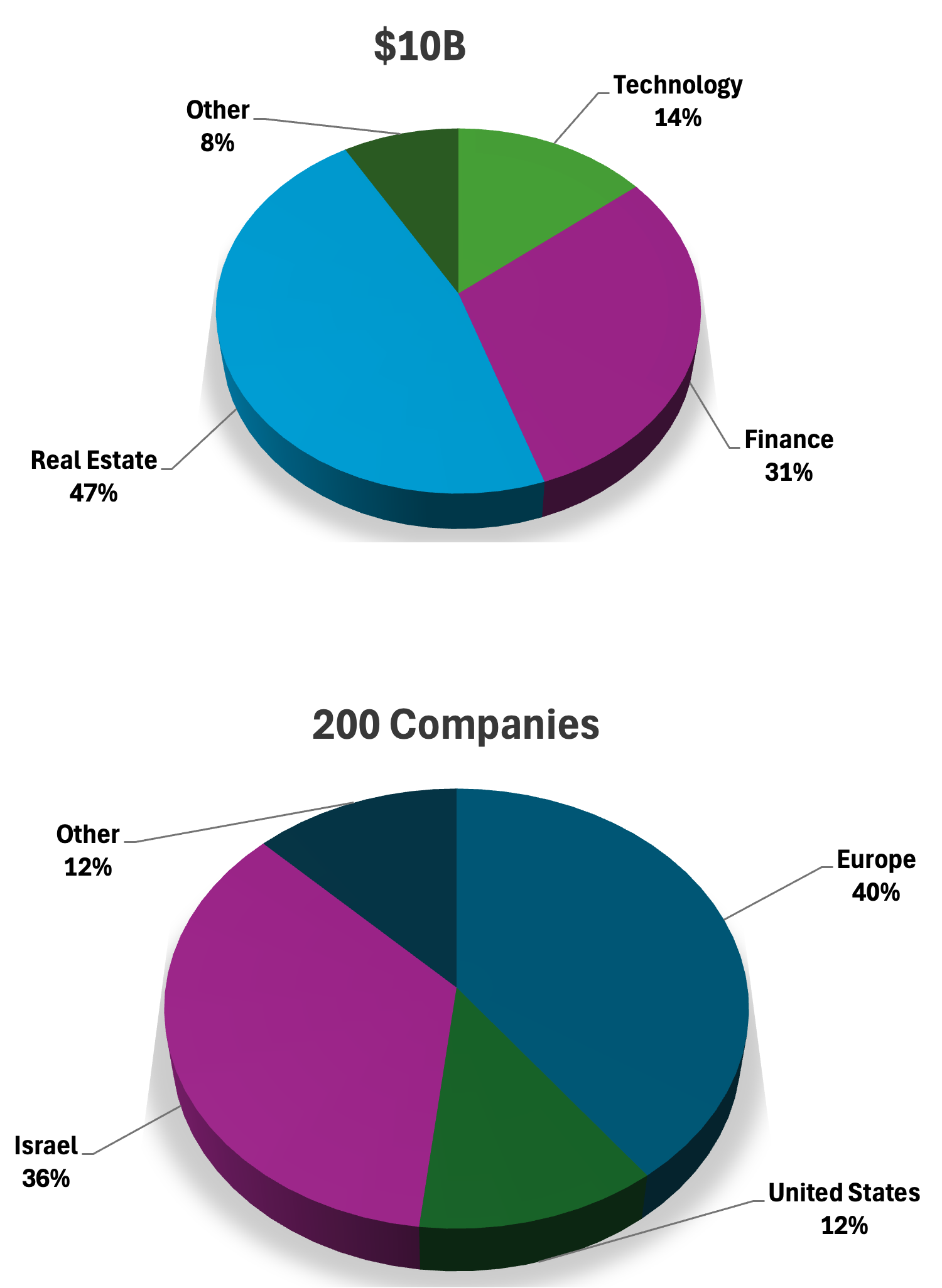

Building Value Across Real Estate, Technology, Finance & Beyond

Who We Are

VAR Group, founded in 2001, is a special-situation investment, management, and advisory group of companies.

Our core approach is to add significant value in the situations we are involved in, typically in leadership positions. These are established through mergers and acquisitions, restructurings, turnarounds, and dynamic, creative thinking combined with meticulous execution.

We are a flexible and innovative player, capable of working on direct properties, portfolios, debts, and equity.

VAR can deploy 100% of the required capital. For larger cases, it can collaborate with private equity and hedge funds, banks, family offices, and institutional investors to lead a process as the operating advisor and/or partner.

Our Sectors

VAR worked with top-tier parties including

-

Fortune 500 companies

-

The world’s largest investment funds

-

Banks and institutional investors

-

Family offices and high net investors

VAR’s main sectors are Real Estate and Finance.

Where relevant, VAR also enhance technologies through acquisitions, JVs or founding specific technology companies.

As VAR has been involved in over 200 companies of various geographies, sectors and sizes (from startup companies to multibillion dollar multinationals), it can also work with an opportunistic approach in other sectors.

VAR is an active player that has founded, managed, advised and exited a long list of companies – and is always looking for new opportunities to lead and/or work with others.